To truly appreciate LinKē you need to see him in action. LinKē is at the core of Middle School MBA’s NextGen curriculum.īut static pictures simply don’t do LinKē justice. LinKē provides the integrated framework, allowing young students to grasp all aspects of business and economics. LinKē is so clear and intuitive that we can teach capital structure, price structure, and business cycle theory to kids as young as ten. Want to see a socialist economy with a withered and distorted capital structure delivering scant and low quality products to consumers? Easy peasy. This allows us to clearly contrast the corresponding lack of consumer price formation in government services. We also show price formation happening at the consumer level and propagating back to natural resources by way of the price structure. In each case we turn various layers on and off to highlight the features of interest. LinKē illustrates traditional banking, fractional reserve banking, and central banking. Then we run the money through the banking system. We layer in streams of money going countercurrent to the products, and see price formation as well as the price structure.

Want to see the business cycle? No problem! LinKē videos dynamically show the misallocation of capital into a given sector, along with the migration of workers to that sector, only to be unemployed as the business cycle turns and businesses shrink during the recession.Īnd what about that “circular flow” of money? Just as we illustrate the capital structure, we also clearly show the price structure, as well as how the price structure drives the capital structure across time.

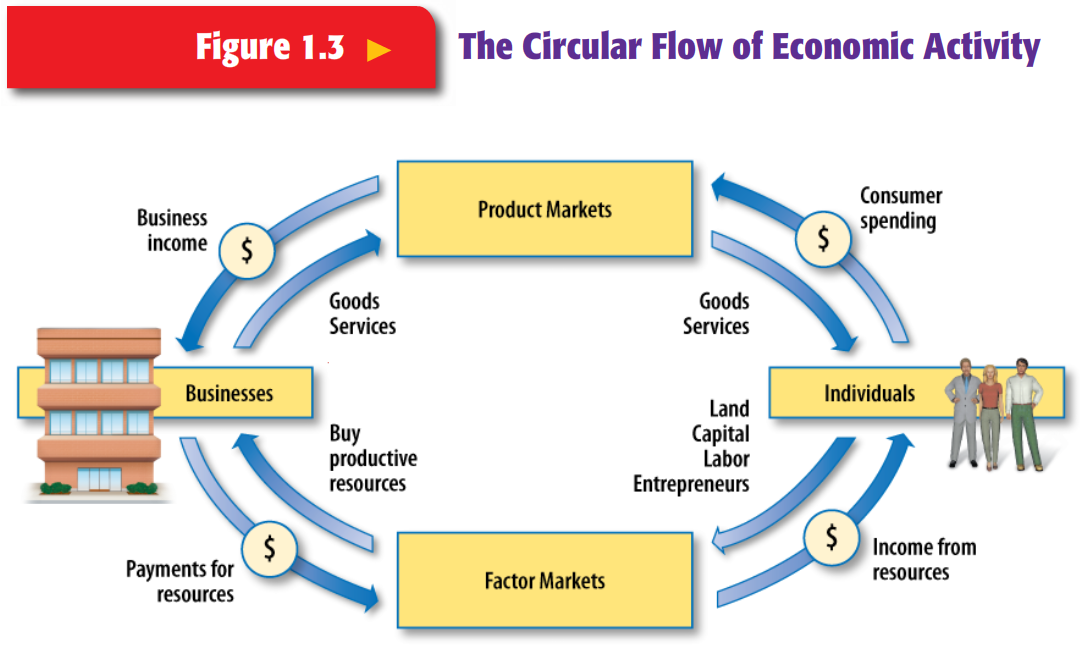

Instead one wonders, “How does this amazing structure arise and what keeps it healthy?” Who could look at LinKē and imagine that arbitrarily shifting capital around might be a good idea? Then by taking away all but the capital, we see the capital structure with it’s various stages of heterogeneous capital. It also demonstrates the element of time as material moves through the production process. LinKē visually represents the traditional factors of production, but in a more granular and realistic way. Zooming back out, we see an economy with heterogeneous capital, specialized workers, and entrepreneurial organization, converting natural resources into products per consumer desires. We have disaggregated the Circular Flow Diagram’s interchangeable “labor” into specialized workers operating specific capital. Zooming in, we see that each business has specialized capital and workers to accomplish its particular task. The LinKē Model illustrates the stepwise conversion of natural resources into products via a network of businesses. No wonder we’re all Keynesians now!īut by using 3D graphics, we’ve built an Austrian-based model that’s simple, rigorous, and comprehensive. Thus, countless millions have a cartoonish mental model of the economy and fall prey to the most blatant nonsense. The obtuse Circular Flow Diagram has simply won by default.Īnd what a victory! Every high school and college econ text puts it front and center. Hayek’s Triangles, Böhm-Bawerk’s Concentric Circles, and the Physiocratic Tableau, all leave users perplexed. Attempts to build such models have floundered. It places consumption before production and supports a fantasy macro world where saving is destructive, deficits don’t matter, and MMT makes sense.īut the economy is just too complex to grasp without some sort of simple, realistic model. Yet, all along we’ve known its shortcomings: over-aggregation, static capital, instantaneous production, and homogeneous factors. The Circular Flow Diagram has dominated economic thought for over a century.

0 kommentar(er)

0 kommentar(er)